How Do You Record A Cash Advance In Accounting . learn how to record an advance to an employee as a current asset in the balance sheet, and how to repay it with. if a customer makes an advance payment, you’ll need to record it differently. if you take a cash advance from a credit card to make purchases for your business, you need to properly account for. learn how to record a payroll advance to an employee as a receivable on the balance sheet and how to repay it from the net pay. See examples of payroll advance journal entries and the accounting equation. learn how to record a cash advance to an employee as a temporary loan and a reduction in cash, and how to deduct the repayment. learn how to record journal entry for advance received from customer in different scenarios, such as security deposit, customized items,.

from www.chime.com

if you take a cash advance from a credit card to make purchases for your business, you need to properly account for. See examples of payroll advance journal entries and the accounting equation. if a customer makes an advance payment, you’ll need to record it differently. learn how to record an advance to an employee as a current asset in the balance sheet, and how to repay it with. learn how to record a payroll advance to an employee as a receivable on the balance sheet and how to repay it from the net pay. learn how to record journal entry for advance received from customer in different scenarios, such as security deposit, customized items,. learn how to record a cash advance to an employee as a temporary loan and a reduction in cash, and how to deduct the repayment.

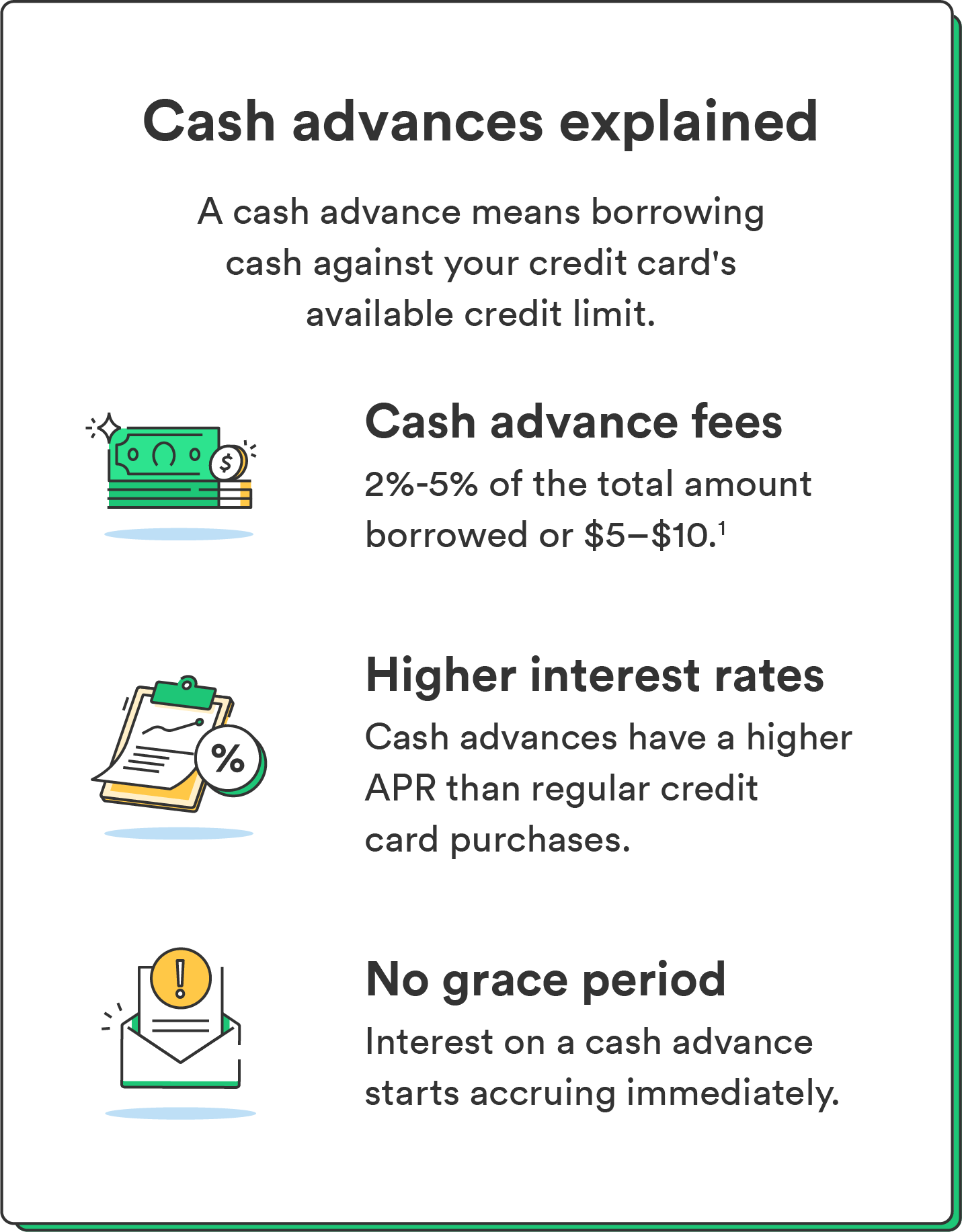

What is a Cash Advance? Chime

How Do You Record A Cash Advance In Accounting learn how to record a cash advance to an employee as a temporary loan and a reduction in cash, and how to deduct the repayment. learn how to record journal entry for advance received from customer in different scenarios, such as security deposit, customized items,. if a customer makes an advance payment, you’ll need to record it differently. if you take a cash advance from a credit card to make purchases for your business, you need to properly account for. learn how to record an advance to an employee as a current asset in the balance sheet, and how to repay it with. learn how to record a cash advance to an employee as a temporary loan and a reduction in cash, and how to deduct the repayment. learn how to record a payroll advance to an employee as a receivable on the balance sheet and how to repay it from the net pay. See examples of payroll advance journal entries and the accounting equation.

From biz.libretexts.org

3.5 Use Journal Entries to Record Transactions and Post to TAccounts How Do You Record A Cash Advance In Accounting if you take a cash advance from a credit card to make purchases for your business, you need to properly account for. learn how to record a payroll advance to an employee as a receivable on the balance sheet and how to repay it from the net pay. learn how to record an advance to an employee. How Do You Record A Cash Advance In Accounting.

From www.goshenaccountingsvcs.com

QuickBooks Online Record an Employee Cash Advance (NonPayroll Version) How Do You Record A Cash Advance In Accounting See examples of payroll advance journal entries and the accounting equation. learn how to record a cash advance to an employee as a temporary loan and a reduction in cash, and how to deduct the repayment. learn how to record an advance to an employee as a current asset in the balance sheet, and how to repay it. How Do You Record A Cash Advance In Accounting.

From spscc.pressbooks.pub

LO 3.5 Use Journal Entries to Record Transactions and Post to T How Do You Record A Cash Advance In Accounting if you take a cash advance from a credit card to make purchases for your business, you need to properly account for. learn how to record journal entry for advance received from customer in different scenarios, such as security deposit, customized items,. See examples of payroll advance journal entries and the accounting equation. learn how to record. How Do You Record A Cash Advance In Accounting.

From accountinginstruction.info

Cash Receipts Journal 40 Accounting Instruction, Help, & How To How Do You Record A Cash Advance In Accounting See examples of payroll advance journal entries and the accounting equation. learn how to record a payroll advance to an employee as a receivable on the balance sheet and how to repay it from the net pay. if a customer makes an advance payment, you’ll need to record it differently. learn how to record a cash advance. How Do You Record A Cash Advance In Accounting.

From ebizcharge.com

What is Advance Billing and how to Account for it? How Do You Record A Cash Advance In Accounting learn how to record journal entry for advance received from customer in different scenarios, such as security deposit, customized items,. learn how to record a cash advance to an employee as a temporary loan and a reduction in cash, and how to deduct the repayment. learn how to record an advance to an employee as a current. How Do You Record A Cash Advance In Accounting.

From accountaholic.weebly.com

CASH RECEIPTS JOURNAL Accountaholic How Do You Record A Cash Advance In Accounting See examples of payroll advance journal entries and the accounting equation. learn how to record a payroll advance to an employee as a receivable on the balance sheet and how to repay it from the net pay. learn how to record a cash advance to an employee as a temporary loan and a reduction in cash, and how. How Do You Record A Cash Advance In Accounting.

From profitbooks.net

How To Record Advance Payment Best Practices & Accounting Entries How Do You Record A Cash Advance In Accounting learn how to record journal entry for advance received from customer in different scenarios, such as security deposit, customized items,. learn how to record a cash advance to an employee as a temporary loan and a reduction in cash, and how to deduct the repayment. learn how to record a payroll advance to an employee as a. How Do You Record A Cash Advance In Accounting.

From www.accountingformanagement.org

Double column cash book explanation, format, example Accounting for How Do You Record A Cash Advance In Accounting if you take a cash advance from a credit card to make purchases for your business, you need to properly account for. See examples of payroll advance journal entries and the accounting equation. learn how to record a payroll advance to an employee as a receivable on the balance sheet and how to repay it from the net. How Do You Record A Cash Advance In Accounting.

From www.double-entry-bookkeeping.com

Cash Advance Received From Customer Double Entry Bookkeeping How Do You Record A Cash Advance In Accounting learn how to record a payroll advance to an employee as a receivable on the balance sheet and how to repay it from the net pay. learn how to record an advance to an employee as a current asset in the balance sheet, and how to repay it with. learn how to record a cash advance to. How Do You Record A Cash Advance In Accounting.

From cealszeu.blob.core.windows.net

What Are Journal Entries In Financial Accounting at Valentina Scales blog How Do You Record A Cash Advance In Accounting if you take a cash advance from a credit card to make purchases for your business, you need to properly account for. learn how to record an advance to an employee as a current asset in the balance sheet, and how to repay it with. See examples of payroll advance journal entries and the accounting equation. if. How Do You Record A Cash Advance In Accounting.

From www.goshenaccountingsvcs.com

QuickBooks Online Record an Employee Cash Advance (NonPayroll Version) How Do You Record A Cash Advance In Accounting learn how to record a payroll advance to an employee as a receivable on the balance sheet and how to repay it from the net pay. if you take a cash advance from a credit card to make purchases for your business, you need to properly account for. learn how to record a cash advance to an. How Do You Record A Cash Advance In Accounting.

From www.goshenaccountingsvcs.com

QuickBooks Online Record an Employee Cash Advance (NonPayroll Version) How Do You Record A Cash Advance In Accounting learn how to record an advance to an employee as a current asset in the balance sheet, and how to repay it with. if a customer makes an advance payment, you’ll need to record it differently. learn how to record a payroll advance to an employee as a receivable on the balance sheet and how to repay. How Do You Record A Cash Advance In Accounting.

From www.goshenaccountingsvcs.com

QuickBooks Online Record an Employee Cash Advance (NonPayroll Version) How Do You Record A Cash Advance In Accounting learn how to record a payroll advance to an employee as a receivable on the balance sheet and how to repay it from the net pay. learn how to record journal entry for advance received from customer in different scenarios, such as security deposit, customized items,. if a customer makes an advance payment, you’ll need to record. How Do You Record A Cash Advance In Accounting.

From www.goshenaccountingsvcs.com

QuickBooks Online Record an Employee Cash Advance (NonPayroll Version) How Do You Record A Cash Advance In Accounting learn how to record journal entry for advance received from customer in different scenarios, such as security deposit, customized items,. learn how to record an advance to an employee as a current asset in the balance sheet, and how to repay it with. if a customer makes an advance payment, you’ll need to record it differently. . How Do You Record A Cash Advance In Accounting.

From ceuhnypp.blob.core.windows.net

How Do You Record Withholding Tax In Accounting at Jade Real blog How Do You Record A Cash Advance In Accounting learn how to record a cash advance to an employee as a temporary loan and a reduction in cash, and how to deduct the repayment. if a customer makes an advance payment, you’ll need to record it differently. See examples of payroll advance journal entries and the accounting equation. if you take a cash advance from a. How Do You Record A Cash Advance In Accounting.

From ddrcqplfeco.blob.core.windows.net

How To Record Accounting Fees at Joel Keesler blog How Do You Record A Cash Advance In Accounting if you take a cash advance from a credit card to make purchases for your business, you need to properly account for. learn how to record a payroll advance to an employee as a receivable on the balance sheet and how to repay it from the net pay. See examples of payroll advance journal entries and the accounting. How Do You Record A Cash Advance In Accounting.

From www.excelstemplates.com

Cash Sheet Templates 15+ Free Docs, Xlsx & PDF Formats, Samples, Examples How Do You Record A Cash Advance In Accounting learn how to record an advance to an employee as a current asset in the balance sheet, and how to repay it with. if you take a cash advance from a credit card to make purchases for your business, you need to properly account for. See examples of payroll advance journal entries and the accounting equation. learn. How Do You Record A Cash Advance In Accounting.

From accountingplay.com

Adjusting Journal Entries Defined Accounting Play How Do You Record A Cash Advance In Accounting learn how to record a payroll advance to an employee as a receivable on the balance sheet and how to repay it from the net pay. See examples of payroll advance journal entries and the accounting equation. if you take a cash advance from a credit card to make purchases for your business, you need to properly account. How Do You Record A Cash Advance In Accounting.